Charitable remainder trust benefits WELS couple donating property

Willi and Pam Schultz

When WELS members Willi and Pam Schultz were ready to sell a vacation rental condominium, they wanted to find a tax-wise way to do so that would not only benefit them financially but also allow them to support the ministries they care about.

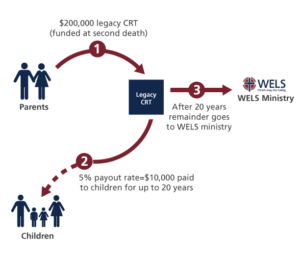

When considering their options, a charitable remainder trust came to mind. “I had read about the charitable remainder trust strategy several times in WELS Foundation mailings over the years, and I had filed the idea away,” recalls Willi.

A charitable remainder trust turned out to be ideal for Willi and Pam’s situation. By donating their property into a charitable remainder trust instead of selling it, the Schultzes enjoyed a charitable income tax deduction and capital gains tax benefits. In addition, the retirement income they will receive from the charitable remainder trust will help offset the income they had been realizing from renting the condominium. And, once the trust ends, the ministries that Willi and Pam have chosen will benefit from their gift.

“It was a win-win-win,” Willi says. “The charitable remainder trust is a fantastic tax-saving and income planning tool!”

Pam liked how the charitable remainder trust fit perfectly into helping them support gospel ministry, like WELS Home Missions and training future pastors at Wisconsin Lutheran Seminary.

“We have been so blessed that we decided to give back to the Lord since everything we have has come from him,” Pam says gratefully. “We know that our blessings will continue to support the work of WELS here on earth even after we have gone to heaven. Nothing is more important than sharing Jesus with others!”

The Schultzes appreciated the partnership with their WELS Christian giving counselors and WELS Foundation staff, who walked them through setting up their charitable remainder trust. “They did an excellent job of helping guide the process,” says Willi. “The greatest benefit was working with people who have a heart for the Lord.”

Learn more about charitable remainder trusts or contact your local WELS Christian giving counselor at 800-827-5482 or [email protected] for assistance.