Called To Support

Northwestern Publishing House

Northwestern Publishing House (NPH) provides Christ-centered, biblically sound resources to the people of WELS and beyond. NPH publishes Forward in Christ and Meditations: Daily Devotional, elementary and Sunday school curricula, Bible studies, worship materials, music, and faith-strengthening books for laypeople. In 2021, NPH released more than 39 Christian resources in print and digital formats, including:

- Christian Worship: God Gives His Gospel Gifts, the final volume in the People’s Bible Teachings series;

- 364 Days of Devotion: A Devotional Book, a follow up to the popular

364 Days of Thanksgiving; - The Story of God’s Love, an abridged Evangelical Heritage Version Bible;

- An Evangelical Heritage Version Study Bible;

- A Theology of the Cross audiobook narrated by sainted Prof. Daniel Deutschlander;

- Here We Stand Bible study for the anniversary of Luther’s stand at the

Diet of Worms; - 10 Lies About God Bible study, which confronts common misconceptions about who God is; and

- 11 music offerings for organ, piano, choirs, and vocal solos, 7 of which draw from new hymns in the 2021 Christian Worship: Hymnal.

In addition, NPH released the majority of the new Christian Worship hymnal suite volumes. NPH will release Christian Worship: Service Builder in late 2021 or early 2022 followed by additional Christian Worship resources. Complimentary copies of the hymnal and psalter were sent to all WELS churches in September 2021.

Visit nph.net or call 800-662-6022 to learn more about the ministry of NPH.

WELS Benefit Plans

The WELS Benefit Plans Office (BPO) serves WELS and Evangelical Lutheran Synod (ELS) workers and organizations through administration of the WELS Voluntary Employees’ Beneficiary Association (VEBA) Health Plan, the WELS Pension Plan, and the WELS Shepherd Plan.

The WELS VEBA Health Plan provides benefits for church and school workers in accordance with God’s Word while remaining compliant with the federal health care reform law. The plan provides comprehensive, nationwide coverage. More than 80 percent of WELS workers and calling bodies participate in WELS VEBA.

Delegates of the 2021 synod convention voted to change WELS’ Pension Plan to a defined contribution plan for future worker retirement benefits. The Pension Plan was frozen on December 31, 2021, which means that no new benefits can be earned under the Pension Plan. Beginning January 1, 2022, eligible workers are being provided with contributions to be used for retirement benefits through a defined contribution plan that is administered through the WELS Shepherd Plan, which is the name of WELS’ retirement savings plan for synod workers.

“There are three main advantages to the change,” notes Mr. Joshua Peterman, director of WELS Benefit Plans. “First, workers will receive meaningful contributions for retirement benefits. Then, workers will have more flexibility to provide for their retirement income needs and to share savings with their survivors. Finally, sponsoring organization costs will remain more stable over time.”

Coverage and benefits provided through WELS Benefit Plans are uniform throughout all 50 states. This supports the WELS ministry and call process because worker call decisions are not influenced by health insurance and retirement benefit decisions.

Visit welsbpo.net for more information.

WELS Church Extension Fund

WELS Church Extension Fund

WELS Church Extension Fund, Inc. (WELS CEF), provides financing through loans and grants to mission congregations so they can acquire land and ministry facilities to be used for gospel outreach in coordination with WELS Home Missions. WELS CEF also provides loans to self-supporting WELS congregations and schools for land and facility projects. The money to carry out WELS CEF’s mission comes from investments and gifts from WELS members, congregations, and affiliated organizations.

In the fiscal year ending June 30, 2021, $15.4 million of new loans and $1.98 million of new grants were approved to mission and mission-minded self-supporting congregations. In addition, WELS CEF provided grants of $1.06 million and $.6 million to the Board for Home Missions from its annual endowment distribution and its newly created annual unrestricted net asset grant program. WELS CEF ended fiscal year 2021 with assets of $229.1 million and net assets of $117.5 million. Three thousand fifty-one WELS members invested more than $106.9 million. The loan portfolio held $184 million in 205 loans to congregations and affiliates.

For more information, visit wels.net/cef.

Pictured: Young members of Grace, Sahuarita, Ariz., watch in excitement as their new church undergoes the construction process. WELS Church Extension Fund provided more than $500,000 in home missions grants to Grace, along with a low-interest loan for the remainder of the cost of the land and construction of its new church.

WELS Foundation

WELS Foundation currently administers more than 1,200 donor-directed planned gifts that support gospel ministry throughout WELS. What an impact on God’s kingdom!

That impact was felt through the distributions to ministry that WELS Foundation was privileged to make in fiscal year 2021. Those distributions included $6.7 million to WELS national ministries, $5.2 million to WELS congregations, and $1.8 million to WELS-affiliated ministries.

This past July, WELS Foundation distributed $1 million to ministry through several synod endowments. In addition, WELS Foundation manages endowments set up by individuals, congregations, and other WELS ministries. In total, WELS Foundation distributed $3.5 million to gospel work from more than 350 endowments this past year.

To learn about leaving a legacy gift to share the gospel with the next generation, visit wels.net/foundation.

WELS Investment Funds

God poured out his blessings on WELS Investment Funds in fiscal year 2021. One of those blessings was the annual investment returns of last year: 25.19 percent for the WELS Balanced Fund and 32.27 percent for the WELS Endowment Fund. These returns had a tremendous impact on the ministries that invest through WELS Investment Funds.

By pooling investment resources through WELS Investment Funds, congregations can take advantage of lower cost, institutionally priced investment alternatives that would not otherwise be available. As more congregations and WELS-affiliated ministries invest in WELS Investment Funds, the cost-reduction benefits increase. As of September 30, 2021, WELS Investment Funds managed $300 million in assets.

For the second year in a row, the WELS Endowment Fund’s net investment return placed in the 90th percentile in a comprehensive annual study of private and community foundations.

To learn why more than 230 WELS ministries have chosen to invest with WELS Investment Funds, visit wels.net/welsfunds.

Financial Services

Financial Services provides accounting and financial services that support and serve WELS ministries.

“WELS is financially strong as God has continued to bless us with the financial gifts needed to maintain existing ministry levels and to develop a well-balanced ministry financial plan for the next biennium,” notes Mr. Kyle Egan, WELS’ chief financial officer.

Synod convention delegates passed the Synodical Council’s proposed ministry financial plan in July 2021. The development of the ministry financial plan is a collaborative process involving the areas of ministry, ministerial education schools, synod leadership, and the Synodical Council.

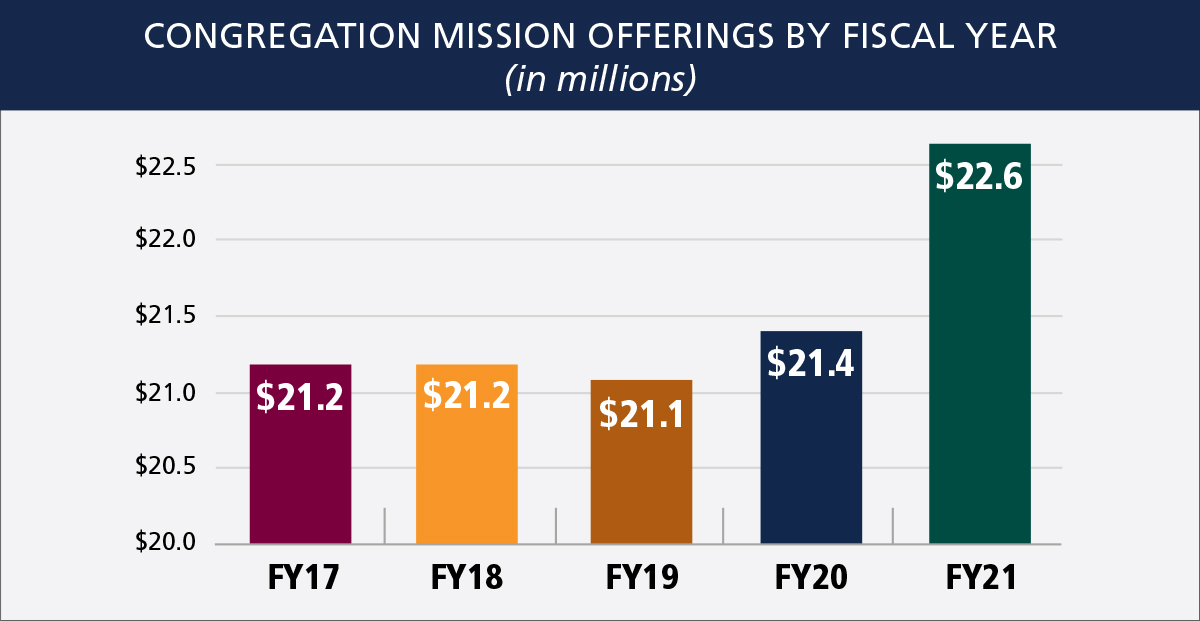

Congregation Mission Offerings (CMO) are critical to WELS’ financial position as these offerings fund nearly three-quarters of WELS’ operating budget. WELS finished fiscal year 2021 (year ended June 30, 2021) with CMO of $22.6 million, which was $1.2 million higher than the previous year and the first time CMO exceeded $22.0 million. In November 2021, the synod learned that its Paycheck Protection Program (PPP) loan was forgiven. Northwestern Publishing House and the four ministerial education schools had previously received forgiveness of their PPP loans.

Another critical component to WELS’ ability to maintain ministries are strong reserves, including the Financial Stabilization Fund. This fund holds all undesignated non-CMO funding sources (gifts, grants bequests, investment income, and other support) for a minimum of one year before being transferred to the operating fund. The financial position of the Financial Stabilization Fund allowed the Synodical Council to approve the transfer of certain reserves from the Financial Stabilization Fund into a new Ministry Opportunity Fund, which will provide a consistent source of funding for unfunded ministry opportunities. The Ministry Opportunity Fund will initially provide a total of $3.0 million in distributions over the next four years to WELS Home Missions in support of its 100 new missions in 10 years initiative.